Wrong.

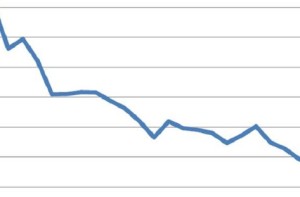

The country has watched month after month as record low mortgage rates have failed to stimulate the economy. The idea is that owners will refinance, thereby carrying a cheaper mortgage which translates into more discretionary spending income per month which will find its way back into the economy and BOOM – America’s back, baby!

But it’s not happening. Unemployment is still high in many metro markets. People can’t afford the closing costs and other fees that are part of a refinance. For many families, that’s a few thousand dollars they need for food as they try to squeak by paycheck to paycheck.

But what about new homes? More of the same. The long-term economic and housing slump over the past few years have sucked a lot of the equity out of existing homes, nationwide as well as here in Hawaii. We don’t need to beat the foreclosure drum here again as that’s been done plenty already, but spiked ARM loans have seriously tanked many portfolios. Families have also seen their cash reserves shrink or outright evaporate from job loss, reduced hours and increased expenses (gas and food, to name a few).

Now not every family is in a negative or dire position as outlined above, but I’m sure we all know people who are on hard times and are watching every penny. If they can find the funds, then the low rates might be something they can take advantage of. It doesn’t matter of they drop further, because they’re pretty good right now! Trying to time it is like trying to time the stock market — find a # you can live with it and lock it in.

What about you? Have you jumped on the low rates this year, either for a new purchase or a refinance? Are you happy with the purchase or do you wish you would have waited?